Dear Partners,

1st quarterly metrics (open banking APIs only)

Dear partners,

Please find below the very first quarterly metrics on NiCKEL open banking APIs since the go-live on June 10th 2025.

Home banking metrics will be published later on, thanks for your understanding!

Production APIs

13 - Build your authorize URL

On the production and sandbox environments, the "scaOauth" property of a consent creation (with header tppExplicitAuthorizationPreferred = false) or a POST /authorization

endpoint is the following:

{

…

"_links": {

"scaOAuth": {

"href": "https://psd.nickel.eu/berlingroup/.well-known/openid-configuration?authorizationId=31f68ab6-1ce6-4131-a324-3f37d2ca4b02"

},

…

}

}

You have to call this URL and retrieve the “authorization_enpoint” property in the response:

{

"issuer": "https://psd.nickel.eu",

"authorization_endpoint": "https://psd-web.nickel.eu/public/berlingroup/authorize/31f68ab6-1ce6-4131-a324-3f37d2ca4b02",

"token_endpoint": "https://psd.nickel.eu/berlingroup/v1/token",

"userinfo_endpoint": "https://psd.nickel.eu/berlingroup/v1/accounts",

"scopes_supported": [

"account",

"payment"

],

"response_types_supported": [

"code"

],

"grant_types_supported": [

"client_credentials",

"authorization_code",

"refresh_token"

],

"code_challenge_methods_supported": [

"S256"

],

"subject_types_supported": [

"public"

]

}

With this property, you will be able to build your authorize URL with the following parameters:

| URI parameter | Description |

|---|---|

| scope |

This parameter corresponds to the consentId of the consent creation or the paymentId of the payment initiation Examples: AIS:1587559935-bae68c2 PIS:1587561419-bp5b5f2 |

| client_id | This parameter corresponds to your NCA id |

| state | Dynamic value that you have to set in order to prevent XSRF attacks |

| redirect_uri |

This parameter corresponds to the URI where the OAuth2 server is redirecting the PSU after the authorization. NB : this redirect_uri has to be the same used for the consent creation or payment initiation |

| code_challenge | This parameter corresponds to PKCE challenge according to cryptographic RFC 7636 which is used to prevent code injection attacks |

| response_type | Type of the response. This value has to be set to “code” |

| code_challenge_method | Optional parameter which corresponds to the code verifier transformation method ("S256" or "plain") |

Following these instructions your authorize URL should look like this and is now valid to process the authorization of the PSU:

This process to build the authorize URL is the same for a payment initiation.

NB : the "redirect_uri" parameter in the URL has to be the same as the "TPP-Redirect-URI" header of the consent creation

12 - Use the fallback solution

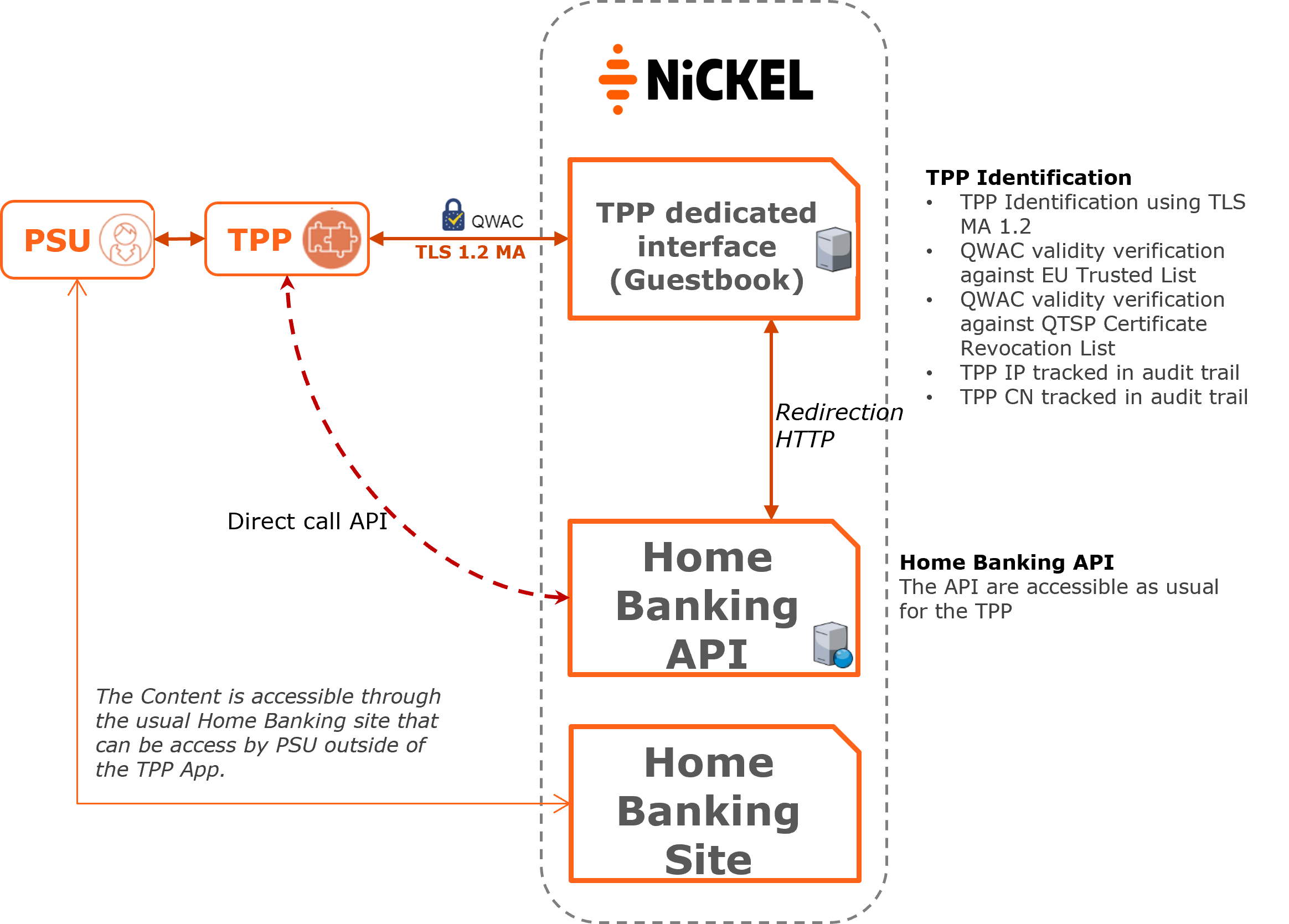

By the Revised Payment Services Directive [PSD2], Account Servicing Payment Service Providers (ASPSPs), are required to grant Third Party Payment Services Providers (TPPs) - conditionally on the requirements of the PSD2 and the RTS - access to their customers’ (Payment Service User's – PSU) bank accounts.

For this purpose, ASPSPs implement dedicated interfaces through which TPPs access the ASPSPs administration system and, thus, the PSU bank accounts.

The dedicated interface allows the ASPSP not only to identify the accessing TPP by certificates but provides a secure access environment to protect PSU data.

With respect to the dedicated interface’s performance and availability, the EBA asks ASPSPs to monitor both and provide contingency (fallback) mechanisms in case the dedicated interface is unavailable.

Therefore, in agreement with the regulator, a fallback mechanism is temporarily made available by Nickel until the dedicated APIs are in place.

The proposed fallback solution allows TPPs to use a new "secure" domain (Guestbook) provided by Nickel.

This additional service carries out regulatory controls required by the EBA, before redirecting the TPP to Nickel Home Banking site.

These controls correspond to:

- TLS MA 1.2 resolution (mutual authentication) with the TPP during each exchange

- Verification that the certificate’s CA is an official QTSP of the EU Trusted List

- Verification that the certificate is not revoked by QTSP via Certificate Revocation List (CRL)

TPPs are required to register in the secured proxy service prior to each session (each AIS and PIS request initiation) in order to perform these regulatory controls.

The Fallback session is represented by a unique identifier (called REQUEST_ID) which is provided by the secured proxy service and which identifies the session. The REQUEST_ID is valid for 10 minutes and the TPP must persist it on their side and provide it in the scrapping request. A Session is defined as follow:

- AIS : Account consultation initialization transaction: a session is a scrapping period of maximum 10 minutes

- PIS : Payment initiation workflow: A session is defined for each payment transaction

For auditing purposes, the unique REQUEST_ID linked to the TPP will be tracked by Nickel.

All these verification requests will be stored and tracked by the secured proxy service. Once all checks have been carried out and validated by the bank's verification service, the TPP will be redirected to the Home Banking site (using http 30X redirect) and will be able to perform "web-scrapping" on the html content as the TPP currently does.

It is the responsibility of the TPP to:

- Respect the fallback process and the RTS (including the limit of 4 AIS workflow without the PSU involvement in a period of 24h).

- Scrapp only the payment accounts for which the PSU gave his consent. The TPP is not allowed to scrapp other existing accounts of the PSU.

Nickel will be able to identify fraudulent TPP as TPP offering connection to the Bank service without being visible in the audit trail of the Fallback solution.

The URL of the secured proxy service solution exposed by Nickel is: https://fallback.nickel.eu

The communication between the TPP and the secured proxy service is always secured by using a TLS-connection Mutual authentication using TLS version 1.2 which is initiated by the TPP.

The TLS-connection has to be established always including client (i.e. TPP) authentication.

For this authentication the TPP has to use a qualified certificate for website authentication (QWAC) which has to be issued by a qualified trust service provider according to the eIDAS regulation, and has to be issued from a production CA (Certificate Authority).

The content of the certificate has to be compliant with the requirements of the EBA-RTS and follow the ETSI TS 119 495 V1.2.1 (2018-11) technical specification.

For security and auditing purpose, the bank requires the client certificate to be presented within each request.

Example of request / response:

The TPP have to call the fallback URL with a valid QWAC certificate.

* Rebuilt URL to: https://fallback.nickel.eu

* …

* Server certificate: Nickel certificate (QWAC)

* …

* SSL certificate verify ok.

> GET / HTTP/1.1

> Host: https://fallback.nickel.eu

> User-Agent: curl/7.54.0

> Accept: */*

>

< HTTP/1.1 302 Moved Temporarily

< …

< Location: Here URL of Nickel home banking website

< …

<html>

<head><title>302 Found</title></head>

<body>

…

</body>

</html>

* Connection #0 to host https://fallback.nickel.eu left intact

Nickel fallback APIs documentation is available here.

11 - Connect to the sandbox or Berlin Group APIs

The communication between the TPP and the Bank (Sandbox or Berlin Group APIs) is always secured by using a TLS-connection Mutual authentication using TLS version 1.2 which is initiated by the TPP.

The TLS-connection has to be established always including client (i.e. TPP) authentication.

For this authentication the TPP has to use a qualified certificate for website authentication (QWAC) which has to be issued by a qualified trust service provider according to the eIDAS regulation.

The content of the certificate has to be compliant with the requirements of the EBA-RTS and follow the ETSI TS 119 495 V1.2.1 (2018-11) technical specification.

During the first connection setup, the TPP will be automatically onboarded and registered (enrolled) in the bank database. However, for security purpose, the bank requires the client certificate to be presented within each request.

Following the EBA clarification 07/06/2019, it's now possible to test the Sandbox using a test certificate. The only restriction is that the certificate used to establish the SSL MA must follow the QWAC format for PSD2, according to ETSI TS 119 495 V1.2.1 (2018-11)

For the Berlin Group APIs, the QWAC certificate has to be issued from a production CA.

Make sure that your QWAC configuration is correct by testing the following endpoint on the sandbox (no headers are necessary)

10 - Contact our support team

As a TPP if you face any problems using either our Sandbox or Production APIs you can contact us by using the dedicated support email : dl-support.psd.api@nickel.eu

Please try to give us the full context of your request :

- TPP Name,

- TPP Registration Number,

- Date and Time of the issue,

- Service : AIS, PIS, FCS,

- Endpoint,

- Error message, error code, screenshot,

- Information about concerned version by using one of the following URLs.

A valid QWAC Certificate for PSD2 is required in order to access these URLs.

The certificate is mandatory, otherwise you will get an error :

Our support team will answer you as soon as possible.

09 - Use our Sandbox Dataset

The sandbox is a mocked environment which allows you to test your application. This environment simulates API responses of the requests described in API page of this developer portal.

To get a response the request has to match certain headers, path and query parameters with specific values described below. Any deviation in these parameters may return in an error code.

The endpoints used in the sandbox environment are identical as those used in production.

You will need to have a valid QWAC Certificate for PSD2 in order to perform the requests on the sandbox. This certificate is mandatory; otherwise you will get an error. The sandbox is freely accessible and you don't need to fulfil an enrolment process to use it

All the specified values to use for the requests will be described in the next paragraphs.

For more details, please refer to the HowTo Manage Consents for Account Information Service

You can create a consent which will create implicitly an authorisation on this consent by setting the header “TPP-Explicit-Authorisation-Preferred” of this request to “false”. In this case, the creation of another authorisation on the consent will be forbidden and you will just have to authorise the consent using the link in the response.

Use the value “VALID_CONSENT_ID” in the request path to test this API.

Here is an example of a body that you can use to test the request:

{

"access": {

"allPsd2": "allAccounts"

},

"recurringIndicator": true,

"frequencyPerDay": 4,

"combinedServiceIndicator": false,

"validUntil": "2030-12-12"

}

If the header “TPP-Explicit-Authorisation-Preferred” is set to true you will have to create manually an authorisation on the consent with the following request in order get the authorize link:

Use the value “CONSENT_ID_NO_AUTHORIZATION” in the request path to test this API.

The authorisation workflow implements the BerlinGroup redirect scenario using OAuth2 SCA Protocol.

In order to test this redirect approach, the sandbox provides a graphical user interface in order to simulate all the possible SCA scenarios (Login fails, timeout, SCA rejected…) that are listed below:

| SCA scenario | Description |

|---|---|

| LOGIN_CANCEL | If the login phase was cancelled by the PSU |

| LOGIN_TIMEOUT | If the login phase encountered a timeout |

| LOGIN_OTHER_ERROR | If another error occurred during the login phase |

| LOGIN_REQUEST_REJECTED | If the login phase was rejected |

| BAD_PASSWORD_LOGIN | If an error occurred during the login phase with a bad password |

| UNKNOWN_LOGIN | If an error occurred during the login phase with an unknown login |

| SCA_OK | To get a successful authorisation |

| SCA_EXEMPTED | If the SCA phase was exempted |

| SCA_CANCEL | If the SCA phase was cancelled by the PSU |

| SCA_TIMEOUT | If the SCA phase encountered a timeout |

| SCA_OTHER_ERROR | If another error occurred during the SCA phase |

| SCA_NOK | If the SCA phase did not succeed |

| SCA_REQUEST_REJECTED | If the SCA phase was rejected |

| SCA_INTERNAL_ERROR | If an internal error occurred |

To access this graphical user interface you have to build your authorisation URI using the scaOAuth URL received in the response of the consent initialisation with the following parameters:

| URI parameter | Sandbox value | Comments |

|---|---|---|

| scope | AIS:VALID_CONSENT_ID | Must be set to this value on the Sandbox. On the production API, Must be set to this the consentId returned by the consent initialisation |

| client_id | VALID_CLIENT_ID | Must be set to this value on the Sandbox. On Production API, you must provide your NCA id |

| state | Any value | On Production API, this is a dynamical value that you have to set in order to prevent XSRF attacks |

| redirect_uri | Any URI value | On Production API, this corresponds to the URI where the OAuth2 server is redirecting the PSU after the authorization |

| code_challenge | Any value | On Production API, this corresponds to PKCE challenge according to cryptographic RFC 7636 (https://tools.ietf.org/html/rfc7636) and is used to prevent code injection attacks |

| response_type | code | Must be set to this value on the Sandbox and on Production API |

| code_challenge_method | S256 | On Production API this parameter is optionnal and corresponds to the code verifier transformation method ("S256" or "plain") |

Following these instructions, you should build the following URI for the sandbox:

This URI will redirect on a mocked page on which you can test the different redirect scenarios of the authorisation flow. All user flow will display an information page before redirecting the PSU to the redirect_uri (HTTP 302 response).

Error management: In order to help TPPs with the errors received through the redirect_uri, Nickel provide more information in the redirect_uri with the properties "psuErrorMessageKey" and "tppErrorTextMessage" in order to better understand the origin of the error. You can test on the sandbox by cliquing on the "SCA Error Cases" buttons as examples.

In order to access the PSD2 requests you need to get an access token for your application. To get this token you have to exchange an authorization_code with a valid token. This authorization_code is found in the 302 response of a valid authorisation.

First of all, you have to use for this request a body encoded as x-www-form-urlencoded.

Here are the specific keys to use for the body of this request: (cf. API /token in API section)

"authorization_code" as value for the "grant_type" parameter

"VALID_CLIENT_ID" as value for the "client_id" parameter

"Any value" as value for the "code_verifier" parameter (On production environment, you have to use the code_verifier of code_challenge provided in the authorize URL)

the following values for the "code" parameter:

| Code | Description |

|---|---|

| AIS_VALID_CODE | Valid code to get an access token for the consent VALID_CONSENT_ID |

| AIS_VALID_CODE_TRANSACTION_90D_KO | Valid code to get an access token for the consent CONSENT_ID_TRANSACTION_90D_KO. This consent is to used in order to get the error of the access right to transactions older than 90 days |

| AIS_VALID_CODE_TRUSTED_BENEFICIARIES | Valid code to get an access token for the consent CONSENT_ID_ALL_PSD2 |

The response to this API comes in the form of a JSON object with the following structure:

{

"access_token": "4db39597dc674268a7fa253d255c47cec7618d14ebdd433a984a7680ce0b77ad0bd76a3a55e8455b980bf41c833a03ce",

"token_type": "Bearer",

"expires_in": 3600,

"refresh_token": "e3da5c9922a34d6e8fa0fa4b780acc2c1ad3a05d485f43f08580250d26a1782b0544973a64204185a9257ca07143c0bb",

"scope": "AIS:VALID_CONSENT_ID"

}

This will be the access that has a limited time validity that you have to use for the future request.

According to Oauth2 specification, you can exchange this access token for a refresh token still using the /Token API but with a “refresh_token” as grant type in the body of the request:

| Parameter | Value |

|---|---|

| grant_type | refresh_token |

| refresh_token | The refresh token that you just got with the /token API |

| client_id | VALID_CLIENT_ID |

The refresh token will have a validity of 180 days, the duration of an AIS consent.

Here are the different consent ids that you can use to test these APIs.

| Consent Id | Description |

|---|---|

| VALID_CONSENT_ID | To retrieve a consent with the status “Valid” and a preselected scope |

| CONSENT_ID_REVOKED_BY_PSU | To retrieve a consent with the status “revokedByPsu” |

| CONSENT_ID_EXPIRED | To retrieve a consent with the status “expired” |

| CONSENT_ID_REJECTED | To retrieve a consent with the status “rejected” |

| CONSENT_ID_TERMINATED_BY_TPP | To retrieve a consent with the status “terminatedByTpp” |

| CONSENT_ID_RECEIVED | To retrieve a consent with the status “received” |

| CONSENT_ID_ALL_PSD2 | To retrieve a consent with the status “Valid” and a “allPsd2” scope |

| CONSENT_ID_AVAILABLE_ACCOUNTS | To retrieve a consent with the status “Valid” and a “availableAccounts” scope |

| CONSENT_ID_AVAILABLE_ACCOUNTS_WITH_BALANCES | To retrieve a consent with the status “Valid” and a “availableAccountsWithBalances” scope |

Here are the different consent ids that you can use to test this API.

| Consent Id |

|---|

| VALID_CONSENT_ID |

| CONSENT_ID_REVOKED_BY_PSU |

| CONSENT_ID_EXPIRED |

| CONSENT_ID_REJECTED |

| CONSENT_ID_TERMINATED_BY_TPP |

| CONSENT_ID_RECEIVED |

This request retrieves the list of the authorisations of the consent.

You can use the value “VALID_CONSENT_ID” in the request to test this API. If you use another value, the consent will be considered as not found.

You can use the value “VALID_CONSENT_ID” and a value for the “consentAuthorisationId” in the request path to test this API. If you use another value, the consent will be considered as not found.

| consentAuthorisationId | Description |

|---|---|

| 11111111-1111-1111-1111-111111111111 | To retrieve an authorisation with the status “finalised” |

| 22222222-2222-2222-2222-222222222222 | To retrieve an authorisation with the status “received” |

| 33333333-3333-3333-3333-333333333333 | To retrieve an authorisation with the status “psuIdentified” |

| 44444444-4444-4444-4444-444444444444 | To retrieve an authorisation with the status “psuAuthenticated” |

| 55555555-5555-5555-5555-555555555555 | To retrieve an authorisation with the status “scaMethodSelected” |

| 66666666-6666-6666-6666-666666666666 | To retrieve a authorisation with the status “started” |

| 77777777-7777-7777-7777-777777777777 | To retrieve an authorisation with the status “failed” |

| 88888888-8888-8888-8888-888888888888 | To retrieve an authorisation with the status “exempted” |

For more details, please refer to the HowTo Access Account Information Services

Here are the different consent ids that you can use to in the “Consent-Id” header to test this API.

You also have to use the access token for the corresponding status.

| Consent-Id (header) | Description |

|---|---|

| VALID_CONSENT_ID | Valid consent |

You have a limited access of 4 times per day to this API. You have to include the IP address from which the PSU accesses the TPP service in the PSU-IP-Address header in order not to apply the restriction.

Here are the different consent ids that you can use to in the “Consent-Id” header to test this API.

You also have to use the access token for the corresponding status.

| Consent-Id (header) | Account Id (request parameter) | Description |

|---|---|---|

| VALID_CONSENT_ID | ACCOUNT_ID | Account of a valid consent |

| VALID_CONSENT_ID | Any unknown account | No permission on this account |

You have a limited access of 4 times per day to this API. You have to include the IP address from which the PSU accesses the TPP service in the PSU-IP-Address header in order not to apply the restriction.

Here are the different consent ids that you can use to in the “Consent-Id” header to test this API.

You also have to use the access token for the corresponding status.

| Consent-Id (header) | Account Id (request parameter) | Description |

|---|---|---|

| VALID_CONSENT_ID | ACCOUNT_ID | Account of a valid consent |

| VALID_CONSENT_ID | Any unknown account | No permission on this account |

You have a limited access of 4 times per day to this API. You have to include the IP address from which the PSU accesses the TPP service in the PSU-IP-Address header in order not to apply the restriction.

Here are the different parameters that you can use to test this API.

You also have to use the access token for the corresponding consent.

| Consent-Id (header) | Account Id (request parameter) | Description |

|---|---|---|

| VALID_CONSENT_ID | ACCOUNT_ID | Account of a valid consent |

| VALID_CONSENT_ID | Any unknown account | No permission on this account |

| CONSENT_ID_TRANSACTION_90D_KO | ACCOUNT_ID | Account where the access right to transactions older than 90 days is expired |

You have a limited access of 4 times per day to this API. You have to include the IP address from which the PSU accesses the TPP service in the PSU-IP-Address header in order not to apply the restriction.

Here are the different parameters that you can use to test this API.

You also have to use the access token for the corresponding consent.

| Consent-Id (header) | Account Id (request parameter) | Description |

|---|---|---|

| VALID_CONSENT_ID | ACCOUNT_ID | valid account to retrieve the standing orders |

Here are the different parameters that you can use to test this API.

You also have to use the access token for the corresponding consent.

| Consent-Id (header) | account-id (request parameter) | Description |

|---|---|---|

| CONSENT_ID_ALL_PSD2 | ACCOUNT_ID | valid consent to retrieve the trusted beneficiaries |

For more details, please refer to the HowTo Initiate a Payment and Manage payments information and status

Here are the different combinations that you can use in the URL of this request:

| Payment service | Payment product |

|---|---|

| payments | sepa-credit-transfers |

| instant-sepa-credit-transfers | |

| periodic-payments | sepa-credit-transfers |

| instant-sepa-credit-transfers |

You can create a payment which will create implicitly an authorisation on this payment by setting the header “TPP-Explicit-Authorisation-Preferred” of this request to “false”. In this case, the creation of another authorisation on the payment will be forbidden and you will just have to authorise the payment using the link in the response.

If this header is set to true you will have to create manually an authorisation on the payment with the following request :

Use the values below in the request path to test this API:

| Payment service | Payment product | Payment Id |

|---|---|---|

| payments | sepa-credit-transfers | PAYMENT_ID_PATC_SCT |

| instant-sepa-credit-transfers | PAYMENT_ID_PATC_ISCT | |

| periodic-payments | sepa-credit-transfers | PAYMENT_ID_PERIODIC_PATC_SCT |

| instant-sepa-credit-transfers | PAYMENT_ID_PERIODIC_PATC_ISCT |

Here is an example of a body that you can use to test the request (single payment sepa credit transfers):

{

"instructedAmount": {

"currency": "EUR",

"amount": "42"

},

"debtorAccount": {

"iban": "FR6010096000303953573683E53"

},

"creditorAccount": {

"iban": "FR5730003000508771112157D50"

},

"creditorName": "DBL Inc.",

"requestedExecutionDate": "2030-01-01"

}

The authorisation workflow implements the BerlinGroup redirect scenario using OAuth2 SCA Protocol.

In order to test this redirect approach, the sandbox provides a graphical user interface in order to simulate all the possible SCA scenarios (Login fails, timeout, SCA rejected…) that are listed below:

| SCA scenario | Description |

|---|---|

| LOGIN_CANCEL | If the login phase was cancelled by the PSU |

| LOGIN_TIMEOUT | If the login phase encountered a timeout |

| LOGIN_OTHER_ERROR | If another error occurred during the login phase |

| LOGIN_REQUEST_REJECTED | If the login phase was rejected |

| BAD_PASSWORD_LOGIN | If an error occurred during the login phase with a bad password |

| UNKNOWN_LOGIN | If an error occurred during the login phase with an unknown login |

| SCA_OK | To get a successful authorisation |

| SCA_EXEMPTED | If the SCA phase was exempted |

| SCA_CANCEL | If the SCA phase was cancelled by the PSU |

| SCA_TIMEOUT | If the SCA phase encountered a timeout |

| SCA_OTHER_ERROR | If another error occurred during the SCA phase |

| SCA_NOK | If the SCA phase did not succeed |

| SCA_REQUEST_REJECTED | If the SCA phase was rejected |

| SCA_INTERNAL_ERROR | If an internal error occurred |

To access this graphical user interface you have to build your authorisation URI using the scaOAuth URL received in the response of the payment initialisation with the following parameters:

| URI parameter | Sandbox value | Comments |

|---|---|---|

| scope | PIS:PAYMENT_ID_RCVD_SCT | Must be set to this value on the Sandbox. On the production API, Must be set to this the consentId returned by the consent initialisation |

| client_id | VALID_CLIENT_ID | Must be set to this value on the Sandbox. On Production API, you must provide your NCA id |

| state | Any value | On Production API, this is a dynamical value that you have to set in order to prevent XSRF attacks |

| redirect_uri | Any URI value | On Production API, this corresponds to the URI where the OAuth2 server is redirecting the PSU after the authorization |

| code_challenge | Any value | On Production API, this corresponds to PKCE challenge according to cryptographic RFC 7636 (https://tools.ietf.org/html/rfc7636) and is used to prevent code injection attacks |

| response_type | code | Must be set to this value on the Sandbox and on Production API |

| code_challenge_method | S256 | On Production API this parameter is optionnal and corresponds to the code verifier transformation method ("S256" or "plain") |

Following these instructions, you should build the following URI for the sandbox:

This URI will redirect on a mocked page on which you can test the different redirect scenarios of the authorisation flow. All user flow will display an information page before redirecting the PSU to the redirect_uri (HTTP 302 response).

The different payment ids to use in the URL and in the “Consent-Id” header of these requests have this structure:

PAYMENT_ID_<payment service>_<payment status>_<payment product>

| Payment service | Payment status | Payment product |

|---|---|---|

| ∅ (payment) | ACCP (AcceptedCustomerProfile) | SCT (sepa credit transfer) |

| PERIODIC (periodic payment) | ACSC (AcceptedSettlementCompleted) | ISCT (instant sepa credit transfert) |

| ACSP (AcceptedSettlementInProcess) | ||

| ACTC (AcceptedTechnicalValidation) | ||

| ACWC (AcceptedWithChange) | ||

| ACWP (AcceptedWithoutPosting) | ||

| RCVD (Received) | ||

| PDNG (Pending) | ||

| RJCT (Rejected) | ||

| CANC (Cancelled) | ||

| PATC (PartiallyAcceptedTechnicalCorrect) |

Examples:

- PAYMENT_ID_RCVD_SCT (« payment – status received - sepa credit transfert)

- PAYMENT_ID_PERIODIC_PDNG_SCT (« periodic payment – status pending - sepa credit transfert)

This request retrieves the list of the authorisations of the payment.

You can use the values below to test this API:

| Payment service | Payment product | Payment Id |

|---|---|---|

| payments | sepa-credit-transfers | PAYMENT_ID_PATC_SCT |

| instant-sepa-credit-transfers | PAYMENT_ID_PATC_ISCT | |

| periodic-payments | sepa-credit-transfers | PAYMENT_ID_PERIODIC_PATC_SCT |

| instant-sepa-credit-transfers | PAYMENT_ID_PERIODIC_PATC_ISCT |

| paymentAuthorisationId | Description |

|---|---|

| 11111111-1111-1111-1111-111111111111 | To retrieve an authorisation with the status “finalised” |

| 22222222-2222-2222-2222-222222222222 | To retrieve an authorisation with the status “received” |

| 33333333-3333-3333-3333-333333333333 | To retrieve an authorisation with the status “psuIdentified” |

| 44444444-4444-4444-4444-444444444444 | To retrieve an authorisation with the status “psuAuthenticated” |

| 55555555-5555-5555-5555-555555555555 | To retrieve an authorisation with the status “scaMethodSelected” |

| 66666666-6666-6666-6666-666666666666 | To retrieve a authorisation with the status “started” |

| 77777777-7777-7777-7777-777777777777 | To retrieve an authorisation with the status “failed” |

| 88888888-8888-8888-8888-888888888888 | To retrieve an authorisation with the status “exempted” |

Payment status notification is currently only supported for Instant Payment. To simulate a Payment Status Notification Event you can call the endpoint

In the body request, you need to provide the following information :

- Payment Id : Payment Id of the notification

- Notification URL: URL where the TPP wants to receive the notification

- Payment status: Payment Status of the event. This can be change to simulate different payment status

Example:

{ |

The Sandbox will then trigger the following callback

POST https://notifications.tppurl.com/ |

For more details, please refer to the HowTo Cancel a Payment

Here are the different combinations that you can use in the URL of this request:

|

Payment service |

Payment product |

| periodic-payments | sepa-credit-transfers |

For the payment Id parameter, here is its structure:

PAYMENT_ID_<payment service>_<payment status>_<payment product>

| Payment service | Payment status | Payment product |

|---|---|---|

| ∅ (payment) | ACCP (AcceptedCustomerProfile) | SCT (sepa credit transfer) |

| PERIODIC (periodic payment) | ACSC (AcceptedSettlementCompleted) | ISCT (instant sepa credit transfert) |

| ACSP (AcceptedSettlementInProcess) | ||

| ACTC (AcceptedTechnicalValidation) | ||

| ACWC (AcceptedWithChange) | ||

| ACWP (AcceptedWithoutPosting) | ||

| RCVD (Received) | ||

| PDNG (Pending) | ||

| RJCT (Rejected) | ||

| CANC (Cancelled) | ||

| PATC (PartiallyAcceptedTechnicalCorrect) |

Examples:

- PAYMENT_ID_RCVD_SCT (« payment – status received - sepa credit transfert)

- PAYMENT_ID_PERIODIC_PDNG_SCT (« periodic payment – status pending - sepa credit transfert)

This request retrieves the list of the authorisations of the cancellation of a payment.

You can use the values below to test this API:

| Payment service | Payment product | Payment Id |

|---|---|---|

| payments | sepa-credit-transfers | PAYMENT_ID_PATC_SCT |

| instant-sepa-credit-transfers | PAYMENT_ID_PATC_ISCT | |

| periodic-payments | sepa-credit-transfers | PAYMENT_ID_PERIODIC_PATC_SCT |

| instant-sepa-credit-transfers | PAYMENT_ID_PERIODIC_PATC_ISCT |

| paymentAuthorisationId | Description |

|---|---|

| 11111111-1111-1111-1111-111111111111 | To retrieve an authorisation with the status “finalised” |

| 22222222-2222-2222-2222-222222222222 | To retrieve an authorisation with the status “received” |

| 33333333-3333-3333-3333-333333333333 | To retrieve an authorisation with the status “psuIdentified” |

| 44444444-4444-4444-4444-444444444444 | To retrieve an authorisation with the status “psuAuthenticated” |

| 55555555-5555-5555-5555-555555555555 | To retrieve an authorisation with the status “scaMethodSelected” |

| 66666666-6666-6666-6666-666666666666 | To retrieve a authorisation with the status “started” |

| 77777777-7777-7777-7777-777777777777 | To retrieve an authorisation with the status “failed” |

| 88888888-8888-8888-8888-888888888888 | To retrieve an authorisation with the status “exempted” |

For more details, please refer to the HowTo Request a Confirmation of Funds

This request checks if funds are available for an account and an amount.

The values below allow you performing the different scenario cases:

| IBAN | Amount on the account | Overdraft of the account | Currency | PIIS Consent existence |

|---|---|---|---|---|

| FR8230066631856742938741993 | 150,02 | 100 | EUR | yes |

08 - Specific BerlinGroup Implementation

- API base URL: https://psd.nickel.eu

- Authorisation base URL: https://psd-web.nickel.eu/public

- Sandbox base URL : https://psdsandbox.nickel.eu

- Sandbox authorisation base URL : https://psdsandbox-web.nickel.eu/public

- BerlinGroup Conformity : Implementation Guidelines

version 1.3

More details on how the APIs work, including sample queries, etc, are available in the Berlin Group's specifications. The above link redirects to the Implementation Guidelines, as well as the Berlin Group specifications in Open API 3.0 format.

A valid QWAC Certificate for PSD2 is required to access the Sandbox and Berlin Group API. The following conditions are verified:

- The certificate must be valid (the connection date is strictly between the creation date and the expiration date of the certificate)

- The certificate must be issued by a QWAC Certificate Authority. The official list of QTSP is available on the eIDAS Trusted List

- The certificate should not be revoked

A TPP can provide and use any number of valid certificates as long as the CA properties and organizationIdentifier stay the same. The old certificates are not revoked when a new valid certificate is presented by the TPP and can be kept in use until their expiration date is passed.

| SCA Approach | Supported | |

|---|---|---|

| Redirect OAuth 2.0 workflow | ✔ | |

| App redirection using App-to-App redirection based on deep linking workflow | ✖ | |

| Decoupled workflow | ✖ | |

| Embedded workflow | ✖ | |

| Services | Supported | |

|---|---|---|

| Support of multiple consents | ✔ | |

| Support of Signing Baskets | ✖ | |

| Support of Card Accounts Endpoints | ✖ | |

| Support display of Account ownerName and ownerNames | ✔ | |

| Support display of Account psuName | ✖ | |

| Owner name always delivered without taking into account the consent scope | ✔ | |

| Support of Trusted Beneficiaries endpoint | ✔ | |

| Support of Multilevel SCA Approach | ✖ | |

| Maximum Frequency Per Day Value Supported on Consent Request | 4 | |

| SCA Validity for a current consent | 180 days | |

| SCA Validity for a one-off consent | 20 min | |

| Consent establishment Timeout | 3 days | |

| Support of parameter withBalance on APIs | ✔ | |

| Supported Account Reference Identifiers | IBAN | ✔ |

| MaskedPan | ✖ | |

| BBAN | ✖ | |

| Consent scope | Dedicated consent (List of accounts) | ✖ |

| Dedicated consent - Support of ownerName in additionalInformation property | ✖ | |

| Dedicated consent - Support of trustedBeneficiaries in additionalInformation property | ✖ | |

| Global consent - availableAccounts = allAccounts | ✔ | |

| Global consent - availableAccountsWithBalance= allAccounts | ✔ | |

| Global consent - allPsd2= allAccounts | ✔ | |

| Global consent - availableAccounts = allAccountsWithOwnerName | ✔ | |

| Global consent - availableAccountsWithBalance= allAccountsWithOwnerName | ✔ | |

| Global consent - allPsd2= allAccountsWithOwnerName | ✔ | |

| Supported Access for MultiCurrency Accounts | ✖ | |

| Multicurrency level | Aggregation level | ✖ |

| Sub-account level | ✖ | |

| Aggregation & sub-account level | ✖ | |

| Balance Type | closingBooked | ✖ |

| expected | ✔ | |

| openingBooked | ✖ | |

| interimAvailable | ✖ | |

| interimBooked | ✖ | |

| forwardAvailable | ✖ | |

| Supported Transactions Query Parameters | bookingStatus = booked | ✖ |

| bookingStatus = pending | ✖ | |

| bookingStatus = both | ✔ | |

| bookingStatus = all to request all types of transactions (pending, booked and information) at once | ✖ | |

| dateFrom | ✔ | |

| dateTo | ✔ | |

| entryReferenceFrom | ✖ | |

| deltaList | ✖ | |

| Support of Standing orders endpoint (bookingStatus=information) | ✔ | |

| Supported optional transaction information (Standing Orders) | debtorName | ✖ |

| instructionIdentification | ✖ | |

| remittanceInformationUnstructuredArray | ✖ | |

| remittanceInformationStructuredArray | ✖ | |

| creditorAgent | ✖ | |

| debtorAgent | ✖ | |

| balanceAfterTransaction | ✖ | |

| Services | Supported | |

|---|---|---|

| Support of Signing Baskets | ✖ | |

| Payment initiation Timeout | 2 days | |

| Support of PIS without IBAN - Retrieval of debtor accounts with AIS flow | ✔ | |

| Selection of debtor account on CBS pages when payment submission without IBAN | ✖ | |

| Funds Availability on Payment Status Information (implicit FCS over PIS) | ✖ |

|

| Support of TPP-Rejection-NoFunds-Preferred Header | ✖ | |

| Support payment status notification (instant payment only) | ✖ | |

| Mandatory Authorisation on Payment Cancellation | ✖ | |

| Supported Access for MultiCurrency Accounts | ✖ | |

| Multicurrency level | Aggregation level | ✖ |

| Sub-account level | ✖ | |

| Aggregation & sub-account level | ✖ | |

| Support display of ownerNames in payment status request | ✖ | |

| Support display of psuName in payment status request and SCA status request | ✖ | |

Support of SEPA credit transfers |

|||

|---|---|---|---|

Payment services |

Single payments |

Periodic Payments |

Bulk Payments |

| Support | ✔ | ✔ | ✖ |

| Cancel | ✖ | ✔ | ✖ |

| Support of Future Dated Payments | ✖ | ||

| Multilevel SCA Approach | ✖ | ||

Optional properties management on payment |

Single payments |

Periodic Payments |

Bulk Payments |

| debtorId | ✔ | ✔ | ✖ |

| debtorName | ✔ | ✔ | ✖ |

| ultimateDebtor | ✔ | ✔ | ✖ |

| currencyOfTransfer | ✔ | ✔ | ✖ |

| instructionIdentification | ✔ | ✔ | ✖ |

| exchangeRateInformation | ✔ | ✔ | ✖ |

| creditorAgentName | ✔ | ✔ | ✖ |

| creditorId | ✔ | ✔ | ✖ |

| creditorNameAndAddress | ✔ | ✔ | ✖ |

| ultimateCreditor | ✔ | ✔ | ✖ |

| purposeCode | ✖ | ✖ | ✖ |

| chargeBearer | ✖ | ✖ | ✖ |

| remittanceInformationUnstructured | ✔ | ✔ | ✖ |

| remittanceInformationUnstructuredArray | ✖ | ✖ | ✖ |

| remittanceInformationStructured | ✖ | ✖ | ✖ |

| remittanceInformationStructuredArray | ✖ | ✖ | ✖ |

| paymentInformationId | ✖ | ✖ | ✖ |

| requestedExecutionDate | ✖ | ✖ | ✖ |

| requestedExecutionTime | ✖ | ||

Support of crossborder payment |

|||

|---|---|---|---|

Payment services |

Single payments |

Periodic Payments |

Bulk Payments |

| Support | ✖ | ✖ | ✖ |

| Cancel | ✖ | ✖ | ✖ |

| Support of Future Dated Payments | ✖ | ||

| Multilevel SCA Approach | ✖ | ||

Optional properties management on payment |

Single payments |

Periodic Payments |

Bulk Payments |

| debtorId | ✖ | ✖ | ✖ |

| debtorName | ✖ | ✖ | ✖ |

| ultimateDebtor | ✖ | ✖ | ✖ |

| currencyOfTransfer | ✖ | ✖ | ✖ |

| instructionIdentification | ✖ | ✖ | ✖ |

| exchangeRateInformation | ✖ | ✖ | ✖ |

| creditorAgentName | ✖ | ✖ | ✖ |

| creditorId | ✖ | ✖ | ✖ |

| creditorNameAndAddress | ✖ | ✖ | ✖ |

| ultimateCreditor | ✖ | ✖ | ✖ |

| purposeCode | ✖ | ✖ | ✖ |

| chargeBearer | ✖ | ✖ | ✖ |

| remittanceInformationUnstructured | ✖ | ✖ | ✖ |

| remittanceInformationUnstructuredArray | ✖ | ✖ | ✖ |

| remittanceInformationStructured | ✖ | ✖ | ✖ |

| remittanceInformationStructuredArray | ✖ | ✖ | ✖ |

| paymentInformationId | ✖ | ✖ | ✖ |

| requestedExecutionDate | ✖ | ✖ | ✖ |

| requestedExecutionTime | ✖ | ||

Identification management for crossborder payment |

Supported |

||

| IBAN | ✖ | ||

| IBAN + BIC + Country Code | ✖ | ||

| IBAN + BIC | ✖ | ||

| BBAN + BIC + Country Code | ✖ | ||

| BBAN + BIC | ✖ | ||

Support of Instant SEPA credit transfers |

|||

|---|---|---|---|

Payment services |

Single payments |

Periodic Payments |

Bulk Payments |

| Support | ✔ | ✖ | ✖ |

| Cancel | ✖ | ✖ | ✖ |

| Support of Future Dated Payments | ✖ | ||

| Multilevel SCA Approach | ✖ | ||

Optional properties management on payment |

Single payments |

Periodic Payments |

Bulk Payments |

| debtorId | ✔ | ✖ | ✖ |

| debtorName | ✔ | ✖ | ✖ |

| ultimateDebtor | ✔ | ✖ | ✖ |

| currencyOfTransfer | ✔ | ✖ | ✖ |

| instructionIdentification | ✔ | ✖ | ✖ |

| exchangeRateInformation | ✔ | ✖ | ✖ |

| creditorAgentName | ✔ | ✖ | ✖ |

| creditorId | ✔ | ✖ | ✖ |

| creditorNameAndAddress | ✔ | ✖ | ✖ |

| ultimateCreditor | ✔ | ✖ | ✖ |

| purposeCode | ✖ | ✖ | ✖ |

| chargeBearer | ✖ | ✖ | ✖ |

| remittanceInformationUnstructured | ✔ | ✖ | ✖ |

| remittanceInformationUnstructuredArray | ✖ | ✖ | ✖ |

| remittanceInformationStructured | ✖ | ✖ | ✖ |

| remittanceInformationStructuredArray | ✖ | ✖ | ✖ |

| paymentInformationId | ✖ | ✖ | ✖ |

| requestedExecutionDate | ✖ | ✖ | ✖ |

| requestedExecutionTime | ✖ | ||

Support of Target2 payment |

|||

|---|---|---|---|

Payment services |

Single payments |

Periodic Payments |

Bulk Payments |

| Support | ✖ | ✖ | ✖ |

| Cancel | ✖ | ✖ | ✖ |

| Support of Future Dated Payments | ✖ | ||

| Multilevel SCA Approach | ✖ | ||

Optional properties management on payment |

Single payments |

Periodic Payments |

Bulk Payments |

| debtorId | ✖ | ✖ | ✖ |

| debtorName | ✖ | ✖ | ✖ |

| ultimateDebtor | ✖ | ✖ | ✖ |

| currencyOfTransfer | ✖ | ✖ | ✖ |

| instructionIdentification | ✖ | ✖ | ✖ |

| exchangeRateInformation | ✖ | ✖ | ✖ |

| creditorAgentName | ✖ | ✖ | ✖ |

| creditorId | ✖ | ✖ | ✖ |

| creditorNameAndAddress | ✖ | ✖ | ✖ |

| ultimateCreditor | ✖ | ✖ | ✖ |

| purposeCode | ✖ | ✖ | ✖ |

| chargeBearer | ✖ | ✖ | ✖ |

| remittanceInformationUnstructured | ✖ | ✖ | ✖ |

| remittanceInformationUnstructuredArray | ✖ | ✖ | ✖ |

| remittanceInformationStructured | ✖ | ✖ | ✖ |

| remittanceInformationStructuredArray | ✖ | ✖ | ✖ |

| paymentInformationId | ✖ | ✖ | ✖ |

| requestedExecutionDate | ✖ | ✖ | ✖ |

| requestedExecutionTime | ✖ | ||

| Periodic payments options | Supported | |

|---|---|---|

| Support of Day Of Execution | ✔ | |

| Supported Execution Rules | Following | ✖ |

| Preceding | ✖ | |

| Supported Frequencies | Daily | ✖ |

| Weekly | ✔ | |

| EveryTwoWeeks | ✖ | |

| Monthly | ✔ | |

| EveryTwoMonths | ✖ | |

| Quarterly | ✖ | |

| SemiAnnual | ✖ | |

| Annual | ✖ | |

| MonthlyVariable | ✖ | |

For SEPA Credit Transfers, Nickel applies batch booking processing. Hence, for those payments, the final status for a successfully processed payment in the XS2A interface is ACCP (AcceptedCustomerProfile), as the payment will be further processed in other backend systems. This is compliant with the Berling Group specification 1.3.12 (see figure “Statuses according applied checks” on page 46, Berlin Group Implementation Guidelines 1.3.12).